Goal Planning

Where Every Angle Matters

What is Goal Planning

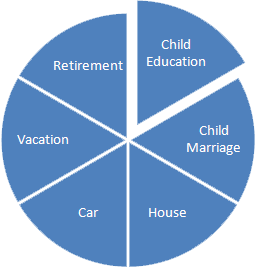

Goal Planning is a long-term process of wisely managing your finances so that you can achieve your goals and dreams. It is a process, which starts with the identification of your specific goals. Once this critical phase is complete, data is gathered and your goals are analyzed in terms of your ability to achieve them. Specific strategies and alternatives which help you achieve your goals are then developed and documented. A specific action plan is then implemented to assure that your overall plan comes to life. Once your plan is up and running, it should be reviewed periodically to assure that you are moving to your goals. These goals may include"

Why Goal Planning

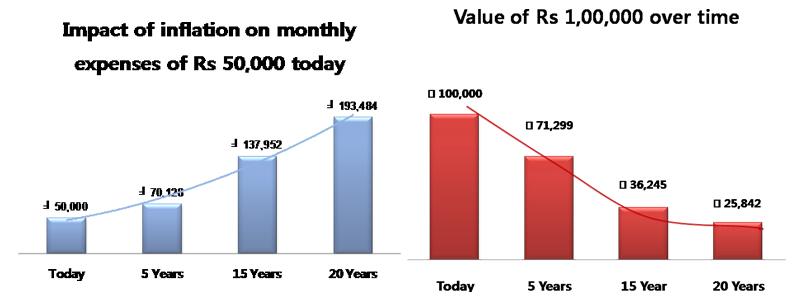

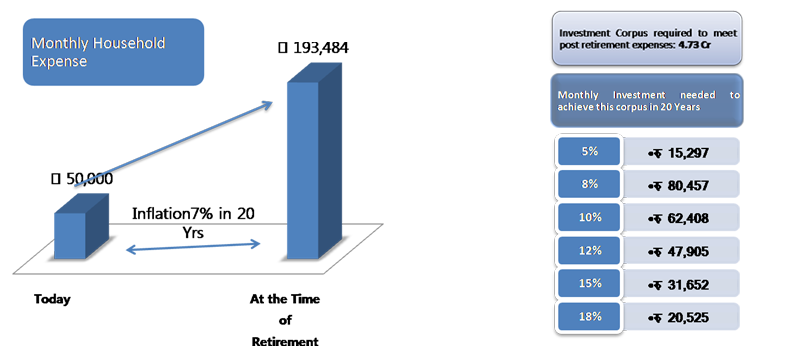

• If your current monthly expenses are Rs 50,000/- per month, then after 20 years you will require Rs 1,93,484 /- a month to just maintain the current lifestyle!

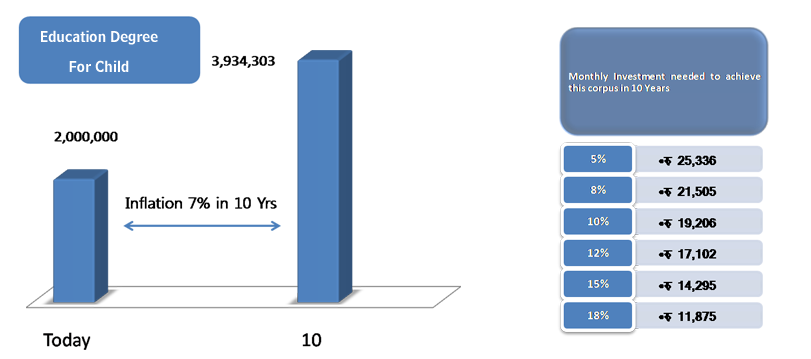

• An education degree for your child which currently costs Rs 20 Lakh could cost over Rs 39 Lakh after 10 Years.

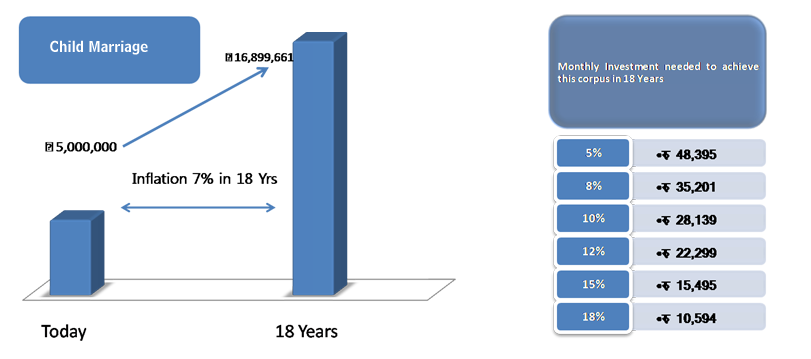

• A Marriage function for your child which currently costs Rs 50 Lakh could cost over Rs 1.68 Crore after 18 Years.

• It is Inflation which is eating out on the Value of Money every year and thus one needs to make a financial plan to beat the inflation and create wealth in long term.

For Example

• At Age 25, if you start investing Rs 5000 per month and your money grows at 12% P.A. you save Rs 2.87 Crore on Retirement at age 60. Just a year’s delay will mean savings of Rs 2.54 Crore, or Rs 32.94 lakh less.

• At Age 35, if you start investing Rs 10,000 per month and your money grows at 12% P.A. you save Rs 1.67 Crore on Retirement at age 60. Just a year’s delay will mean savings of Rs 1.47 Crore, or Rs 19.96 lakh less.

• At Age 45, if you start investing Rs 30,000 per month and your money grows at 12% P.A. you save Rs 1.30 Crore on Retirement at age 60. Just a year’s delay will mean savings of Rs 1..12 Crore, or Rs 18.14 lakh less.

| Amnt P.M. |

% Growth |

Years |

Investment |

Value |

| ₹ 10,000 |

5%

|

20

|

₹ 2,400,000 |

₹ 4,127,463

|

| ₹ 10,000 |

8%

|

20 |

₹ 2,400,000 |

₹ 5,929,472

|

| ₹ 10,000 |

10%

|

20 |

₹ 2,400,000 |

₹ 7,656,969

|

| ₹ 10,000 |

12%

|

20 |

₹ 2,400,000 |

₹ 9,991,479

|

| ₹ 10,000 |

15%

|

20 |

₹ 2,400,000 |

₹ 15,159,550

|

| ₹ 10,000 |

20%

|

20 |

₹ 2,400,000 |

₹ 31,614,794

|

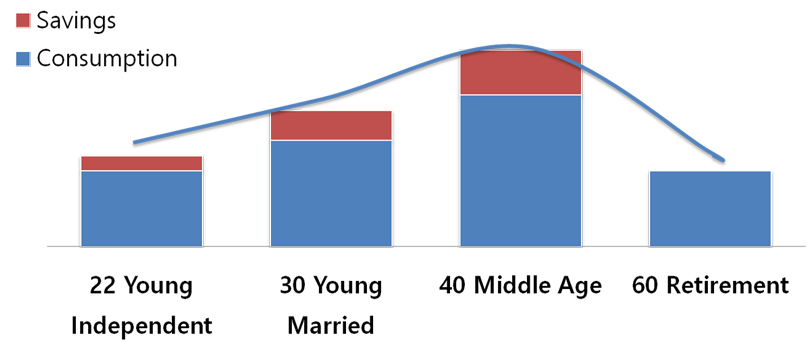

Individual Investor : Life Stage

All Individuals have a finite period to save for their investment goals

Value of Money Over Time

What investment is appropriate

• Debt, PPF, Post office Scheme, Fixed Deposits, Debentures ,Bonds ,Income Funds, Liquid funds.

• Equity , Individual Stocks, Growth Funds, Sectoral funds.

• Bank: Bank Deposits.

• Or a mix of above

• A good investment is one that helps you maximize your total returns, net of taxes and inflation over the time period you invest for!

Retirement Planning

Child Education Planning

Child Marriage Planning